I'll be back in 2024!

The 'Couv'

Tuesday, December 26, 2023

Tuesday, November 28, 2023

2023 Is Coming to a Close, Washington Remains Favorable.

Washington still looks good for retirees. Low taxes for seniors and a strong economy keeps Washington State popular among young workers and seniors alike. Although the bulk of retirees still tend to choose warmer more southerly locales, Washington remains popular compared to other northern latitude states.

I wrote an article earlier this year about grandparents moving to be close to grandkids. Washington is ideal for that scenario as robust job growth continues statewide but particularly the top five urban counties which are King County, Pierce County, Snohomish County, Clark County, and Spokane County.

Clark County enjoys the advantage over the three Puget Sound counties as having a much more affordable housing, lower taxes, and a close proximity to Portland, OR. Although Spokane has the lowest housing prices of the five, Spokane is more isolated and lacks proximity to a major US city.

Meanwhile Washington State is ranked 13th in population among the fifty states and had the second fastest growth rate of the top 15 states by population. Only #2 Texas grew faster. Washington's robust migration ratio is bringing people by the tens of thousands every year. With both California and Oregon losing population, Washington remains the only West Coast state enjoying growth. For the young and the old, Washington is leading the charge.

SW Washington has something for everyone and that puts us in a very enviable position.

Tuesday, October 24, 2023

Some Bankers think Relief is Coming Next Year

originally posted in Rod's Real Estate News, 9/29/2023

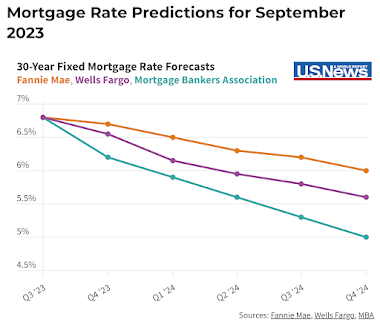

According to US News and World Report the trend for the next few months is a softening in rate pressure. Rates should start to ease a bit providing some relief for weary buyers that have been priced out of mortgages over the last couple years. Locally rates have been running at nearly 8% well above the national average. The chart below shows the national trend and the rates on the chart or prior to any fees or points that banks are in fact charging. Rates that borrowers are actually seeing or will see based on this chart would be 0.5% to 1% higher. Rates also vary based on the lending program, down payment amount, credit profile and other important financial details of the borrower. The good news is they seem to think it is starting to trend favorably for borrowers.

Wednesday, September 27, 2023

Vancouver's Urban Core Still Booming

Vancouver has seen a tremendous growth boom in the city center over the last seven or eight years. The skyline has been filled with an assortment of tower cranes hovering over large mid-rise and high-rise projects for better part of a decade now.

Retirees looking for that city living opportunity can enjoy a walkable neighborhood experience in Downtown Vancouver while living in one of dozens of secure mid-rise and high-rise apartment or condominium developments. The Springs Living is the latest senior living development and it is the largest such project in the area. The 12 story tower is topped out and expected to open sometime next summer on Vancouver's Waterfront.

Below is a video showing off some of the development and condo opportunities in Vancouver's urban core. Take a look at the amazing progress in our city center.

Tuesday, August 22, 2023

Inflation Making Fixed Income a Challenge

Although the rate of inflation seems to have peaked it still remains a bit high at around 3.2%. Inflation tends to eat away at fixed income spending power especially since many COLA (Cost Of Living Adjustments) are capped at 2-3%. For retirees not having an income tax in Washington State helps quite a bit, but rising gas prices due largely to a sneaky tax the state applied recently cuts into the budget quite a bit. That gas tax will likely appear on the ballot in November for voter approval. If it is rejected gas prices will drop by nearly 50 cents a gallon.

It is important for voters, particularly retired people, to pay close attention to what our state and local politicians are doing. They are often sly like the fox and when they are it usually will hit us in the wallet. Locally the economy remains fairly strong all things considered and there is a great deal of positive activity happening. For retired people that means opportunity for part time work for extra cash. Employers have been struggling to fill positions for the last few years and many seniors are making some side hustle cash to help alleviate the pains of inflation.

In other news: The Springs Living on Block 18 at the Waterfront is topped out and they seem to be on track for a summer 2024 opening. This will be the premier retirement faculty in the region with 12 floors, a private restaurant and views galore. They will offer indecent living all the way to advance memory care. This is an exciting addition to Vancouver's already spectacular Waterfront. Urban Living in the Couv follows the project, here.

Tuesday, July 25, 2023

What Hits Your Wallet Harder, Income Tax or Sales Tax?

Well that's a loaded question up there in the headline. Honestly the best answer for an individual is found by consulting your tax professional. Everybody has a slightly different tax profile depending on a variety of variables in our excessively complex tax-code. Since most of us are stuck paying Federal Income Tax, the question really falls into the realm of state taxes. Locally in Washington State we do not levy an income tax on our residents. We do levy a rather stout at times sales tax on a broad range of taxable products. Our southern neighbor, Oregon does not have a sales tax but they do have a blistering income tax that pounds away at even the poorest of Oregon residents.

The general rule of thumb is that an income tax is heavily burdensome on high income earners and a sales tax punishes the poor. The reason this is often cited is that poor people tend to avoid income tax as most income taxes have a base deduction that keeps the poor from paying a lot of tax. Someone earning $25,000 a year might only pay a couple hundred dollars in tax because their adjusted gross income could be as low as $5000 if they have a family and other tax subsidies.

Sales tax seems burdensome to the poor as they have to pay it on all their purchases for which they struggle to earn enough money. Of course some of life's essentials are exempt from sales tax in particular, food products. But it is true that the poor feel the hit of a sales tax more than they do an income tax as again most truly poor residents will end up paying very little in income tax, even in Oregon where they start charging 8.75% at the adjusted gross income of just $9450 a YEAR! Ouch that's brutal.

So in general a retiree with a strong pension or a large 401k distribution will definitely fare better in Washington State than neighboring Oregon. Many SW Washington residents shop in Oregon to avoid sales tax and in so doing are double dipping the system a bit. Bear in mind Washington's sales tax is also a use tax and technically Washingtonians are expected to report purchases out of state and pay the appropriate tax minus any local taxes. This is difficult for the state to enforce however other than items that require registration such as vehicles or firearms. Items shipped into the state from Oregon will also be subject tot he sale tax so yeas, you have to get in the car and drive ;)

If you are retired or soon to be so and are considering the Pacific Northwest, be sure to consult your tax professional for advice on whether the Sales Tax or the Income Tax is the bigger bite out of your wallet.

Tuesday, June 27, 2023

Healthcare in SW Washington State

Healthcare is a critical piece for most retirees. As we age we find ourselves at the doctors office a bit more often. Access to that care is not equal in all places. Smaller cities and rural areas often have more limited resources and routine care for older people may require long trips to the "city."

Southwest Washington has an abundance of healthcare options. Clark County in particular is rich with facilities and trips out of Clark County are rarely needed with a notable exception being Kaiser Permanente that has a few services only available Portland or at their Sunnyside (Clackamas) location. Vancouver has two large hospitals each with substantial cottage industry healthcare around them.

Peace Health Southwest Washington Medical Center on Mill Plain in the Heights is one of the regions largest and most comprehensive hospitals. Legacy Salmon Creek is the second largest hospital in Clark County and also has a wide range of services available with numerous doctors offices and clinics nearby.

Kaiser Permanente operates several clinics ranging from small to large in Clark County mostly in Vancouver. Vancouver Clinic has numerous facilities in Vancouver and around Clark County with a broad range of outpatient services. The VA operates a clinic and small hospital near Fort Vancouver for our veterans.

Local healthcare systems with a large presence in Clark County:

- Peace Health, based in Vancouver, WA. Closest hospital, SW Washington Medical Center, Vancouver. Local clinics 10+

- Legacy Health Care, based in Portland, OR. Closest hospital, Legacy Salmon Creek Hospital, Vancouver. Local clinics 10+

- Kaiser Permanente, based in Oakland, CA. Nearest hospital, Interstate Medical Center, Portland (Kaiser contracts with Legacy Salmon Creek for some care). Local clinics 6+

- Providence Health Care, based in Renton, WA. Nearest hospital, Providence Portland Medical Center, Portland, OR. Local clinics, 6+

- Vancouver Clinic, based in Vancouver, WA. Closest hospital N/A. Local clinics 10+

- Veterans Administration, based in Washington DC. Nearest hospital, Vancouver VA (limited services) Portland VA, Portland OR. Local clinics 3+

Tuesday, May 23, 2023

Inslee Signs Legislation ending SFR zoning, Good for Retirees?

Washington is not the first state to effectively end the Single Family Residence (SFR) zoning but they are the latest. As a real estate professional I have mixed feelings about this legislation. Although it is designed to help increase available housing and decrease suburban sprawl, it could have negative consequences for the very people it claim to help. Only time will tell of course.

The idea is that SFR neighborhoods consume allot of space and tends to be more expensive housing that excludes allot lower income people from affording. Allowing multifamily projects in these neighborhoods helps to increase housing that is traditionally more affordable.

So what does the law really do? Well it states that cities with 25,000 to 75,000 people can not zone SFR and must allow at least duplex style (2 units) MFR (Multi Family Residential). In cities with more than 75,000 people which in Clark County means Vancouver only, four flexes are the minimum threshold. So in effect neighbors living in SFR neighborhoods could apply to convert their single family home into a duplex or four-plex depending on the size of their city. Having a bunch of four-flex units would definitely change the character of a neighborhood; generally for the worse. Quiet neighborhoods could become crowded, and obviously filled with renters that often do not take pride in the upkeep and presentation of the home. The upside is that more affordable housing becomes available and that could take pressure off rental prices.

There is another downside that I am 99% certain our legislators and governor are not smart enough to see. Politicians are usually not the brightest bulbs on the tree. That is that the dream of living in a quiet single family home neighborhood will likely evaporate for the people at the lower end of the middle class. A piece of the American Dream will be taken away from the very people the law is designed to help. Why is that, you ask? Because neighborhoods lacking duplexes and four flexes will slowly become more rare and thus more expensive pushing pricing even higher. Neighborhoods with a mix of SFR and MFR will become more affordable, but the true single family home experience will be missing.

So what does this have to do with retirees? Ah that is the question and the answer could be rather favorable. If this law survives the inevitable legal challenges, retirees living in a large house will legally have an option previously unavailable. Rather than sell the house and downsize, they could convert the house to multi-family and stay put utilizing one of the units as their own and renting the other(s) out to subsidize their income at a time when extra income is most appreciated.

This will not be the solution for everyone and I am not sure whether this legislation will supercede deed restrictions (CCRs). It is worth watching for retirees that would like to stay in their current home but either cannot justify the expense of a large home or is unwilling to keep the larger space clean and tidy. This could provide income from an asset that very well may be paid off already. Not a bad way to go.

As I understand the law, and let's be really clear here: I am a Realtor® not a lawyer, The laws does NOT prevent developers from building single family homes, it simply strips local government of the right to zone exclusively for single family homes.

Locally, Vancouver is the only city in Clark County and in fact all of Southwest Washington that will be subject to the four-flex requirement. Battle Ground and Camas are large enough to fall into the duplex category as is Longview in Cowlitz County. Everywhere else in Clark County and Southwest Washington will be exempt from the restrictions this law places on zoning. So people living in Vancouver's unincorporated areas, which is nearly half of Vancouver's residents, should also be exempt from this law. Again I am not a lawyer so if you have genuine concerns consult an attorney or your local governing agency for clarification.

The bottom line is that CCRs authority against the authority of this legislation will be a critical factor in determining whether this law will have more negatives than positive or more positives than negatives. If deed restrictions prevail then the law should be mostly favorable. Property rights are a big part of out constitutional rights and I take them very seriously. If you own property you should too.

Tuesday, April 25, 2023

Boomtown or Depressionville?

Originally published October, 23, 2018 by Rod Sager

Originally published October, 23, 2018 by Rod Sager

Should Retirees Avoid areas with Strong Economies?

That seems like an odd question, right? Frankly, it is odd, yet there is merit to thinking it through. A strong economy is very important for many reasons. There are lots of job opportunities, local governments tend to be flush with cash to keep things operating smoothly, property values tend to rise, etc. So why would all that be anything but great for a retiree? The answer is not yes or no, but rather, "it depends."Generally retirees are not too concerned with the job market they are after all, 'retired'. Retirees are generally living in the last house they will ever own so property values that are high simply reduce the amount of house they can afford and any future profit is deferred to heirs.

But retirees living in an area with a depressed economy have other things to be concerned with. Crime, quality of services, etc. The retiree may be able to buy a much larger and nicer property in an area that is not experiencing an economic boom, thus quality of life could be enhanced.

In the end it really does depend. Retirees that are going to be on a tight budget may want to consider areas that are not quite as booming so as to keep housing expenses reasonable. Retirees in the middle of the financial pack can consider either scenario and those that are in really strong shape would probably benefit from the robust economic conditions of a boom economy.

Regardless of the financial standing of the retiree, a strong housing market is a valuable friend so long as the property is owned and not rented. Even though the appreciation in value is likely to benefit heirs, there are scenarios whereby that equity can be leveraged by the retiree later in life. A reverse mortgage for example can provide income later in life should other resources become scarce.

There are a great many things to consider before making that decision on where to retire. Consulting a professional financial planner is typically a wise move. Washington State offers a wide variety of areas spreading across a large swath of incomes and property values. No income tax and senior discounts on property taxes for qualifying seniors makes Washington State a fantastic place to retire.

Tuesday, March 28, 2023

Following Grandkids?

As a long time veteran real estate agent, I have seen many clients move here or away from here to follow their grand children. In my own personal scenario my wife's parents moved to Vancouver to be close to their grandchildren after growing tired on long travels for visits. It is a powerful force this gravitational tug of baby descendants. I'm feeling it my self as my first grand baby is expected in July. I already want to be closer to my son and daughter-in-law. But Chicago? Not happening.

Washington State has a roaring economy which has been firmly in the top five in the country for more than a decade now. Strong economies produce high paying jobs and lots of opportunity for young people. This in turn draws young families to the region and sometimes draws grandparents as well.

If you have a child looking at new job opportunities in Portland, OR or Seattle, WA but also looking at other areas, say Illinois, New York, DC, etc. it might not hurt to lean on them a little in favor of the Northwest. Either way you can choose Washington when you follow them and enjoy our top tier retiree situation. Mainly: no state income tax.

I have written ad nauseam about the wonders of Washington State with our diverse geology and climate. The taxes and advantages of Washington laws benefit retirees greatly. Although the west side can be cloudy and drippy it tends to be free of extreme weather. I hate extreme weather. We don't get bitter cold, we don't get super hot, we don't suffer extreme humidity in the summer, we don't get a whole lot of snow in the valleys, and we don't have a lot of natural disasters. These are all great things, and other great things include some of the most spectacular natural scenery in the country, and even a diverse political spectrum with something for everyone left or right.

So nudge your kids towards the nice job in the Northwest and then pack up and follow them to paradise.

Tuesday, February 28, 2023

2023 Real Estate, how are we doing?

For those of you subscribed to both my Real Estate Blog and this blog, I have a rerun this month. Last week I went over the January real estate stats and facts to get a feel for how we are headed in 2023. This information can be important for retirees as well since often a change in homes is part of the retirement plan. So for lack of a superior excuse, here is that report from my real estate blog.

originally published February 24th, 2023 by Rod Sager

January is typically a slower month for closed real estate transactions. But the numbers can still provide a trend insight. January 2023 produced 306 closed single family homes including condos in Clark County. The median price was $490,000 and the average a bit higher at $543,000. For review, the median is the halfway point so half sold for less and half sold for more than the median. Average is a classic mathematical formula add up all the sales and dived by the number of sales. Because there is a lot more room at the top of the range locally the average tends to be higher than the median.

Roughly 100 homes sold between $400-$500k and another 100 between $500-$750k. That is a the meat of the local market with about 2/3 of transactions falling that range $400-$750k.

Compared to last year, January 2022 numbers were 507 closed units with a median price of $493,000 and an average of $553,000. As I have been reporting over the last year, values seem to be holding steady and the numbers bear that out. What has dropped is the volume of transactions. We only closed 60% as many transactions this past January as the prior year. The difference between the two years isn't o much demand as it is interest rates. Rates were comfy in the 3's in January 2022 where they were a more average 6's last month. Fewer buyers qualified to purchase in 2023 than last year, plain and simple.

So as of this first month's data, the sky is not falling and neither are prices. $490k vs. $493k is akin to a rounding error. What is happening in the market is buyers are not willing to pay large amounts over asking price unless the house is priced ridiculously low. Buyers are more sensitive to price in this current market, but they will pull the proverbial trigger on a well priced home. In fact they did just that 306 times last month.

I'll be watching the trends closely during March and April as these are the months that tend to set the tone for the local market during the late spring and summer peak season. I'm a cautious bull on Real Estate for Q2, 2023.

Tuesday, January 24, 2023

Reverse Mortgage? Free and Clear? Mortgage?

Some retirees find themselves sitting on a large equity pool from the family home they no longer need. There are a variety of options in this scenario especially when downsizing the home. Owning a home free and clear is often a goal for people when they retire. This can be an excellent tool for maintaining a similar lifestyle in retirement as enjoyed in the working years. Having a home free and clear is ideal for people that want to leave a legacy inheritance for future generations. If this path is chosen people should be mindful of scams that aim to secure title away from the owner. When a bank has a lien on a property it is much more difficult for title thieves to get at your property. This is one advantage to having a small first position lien against the home.

Some retirees that have strong fixed income may choose to hold on to their cash and carry a traditional mortgage note through retirement. There can be tax advantages to this position if income levels are high enough and other tax deductible schedule A items are present. It also helps to keep title thieves at bay with a lender lien in place.

The reverse mortgage can be a great way to ensure stable living arrangements till death do you part. Sometimes depending on the age of the applicants income can be derived from this method as well. This can be a good way to go for retirees that are house rich and cash poor or are carrying a smallish mortgage of 30-50% LTV. A reverse can eliminate the payment and carry a payment free home until the owner no longer lives there. It is possible to purchase a home with a reverse mortgage as well as refinance into a reverse from an existing free and clear house or even a financed home when LTVs are low enough. Age plays a major role in the value of a reverse mortgage.

All three of these can be solid options but retirees should be careful to check with a qualified tax accountant and or their attorney to be sure they understand the ramifications of each scenario. Washington State does have favorable programs for senior citizen residents from property tax deferral and reductions to generous terms on reverse mortgages.

Western Washington remains a great place to retire with year round mild weather and spectacular scenery.