Holiday Hiatus.

The 'Couv'

Tuesday, December 28, 2021

Tuesday, November 23, 2021

Clark County Median Home Price now closer to a Million than Zero

Clark County Washington's median home price has now crossed over the half million dollar mark making that headline, technically true. For retirees expensive housing markets can be challenging especially for those on a fixed income. Fortunately retirees have a completely different set of location needs that sometimes allow them to get a deal on homes in areas unfavorable to families but setup close to services for the elderly.

Also families will have a hard time working with a two bed one bath home, but retirees can make that work. Condominiums may provide an easy maintenance and lower price particularly suburban condos. The urban mid-rise and high-rise units Downtown are rather expensive with a few notable exceptions such as Parkview at Vancouvercenter.

For retirees in Clark County it has become slim pickings for homes under $400k even two bedroom homes are now breaching that threshold. With inflation on the rise and interest rates that have yet to respond, we can expect even higher prices over the short term. Long effects of inflation could lead to higher interest rates and a possible slowdown in housing resales by the elimination of qualified borrowers.

The good news is that buyers securing low interest loans on a fixed rate will be set up nice when rates climb and even if home values take a dip, the low interest rate may very well pay for the difference in price later.

Tuesday, October 26, 2021

Uncle Sam is Coming for your Wallet

Tuesday, September 28, 2021

Reverse Mortgage Purchase Looks Attractive Now

The Reverse Mortgage as a purchase tool in the current market is perhaps stronger than ever before. With rates under 3% possible and inflation at record levels, this product is a solid tool for any retiree with some cash on hand or large amounts of equity. Generally a younger retiree, say 65 years old will need at least half the purchase price in cash. Selling a home with a large amount of equity and downsizing can lead to a large down on the new house. Now the retiree can live in the house indefinitely without paying a mortgage payment. In some cases if the property was free an clear, the bank will pay a monthly payment to the homeowner indefinitely. The low interest rates make reverse mortgages an attractive alternative to more conventional financing methods. It is not for everyone, so borrowers should consult a trusted mortgage professional.

The premise is this: Borrower puts a large down payment or refinances a free and clear property. The older the borrower the more flexible the terms. Generally 50% down is a minimum requirement. The borrower makes no payments. The interest accrues as normal so every month a little bit more interest is applied as the loan balance grows. When the borrower leaves the residence, the bank collects the full amount of the balance. Typically this would be done by selling the house and paying off the mortgage with the proceeds. Any left over amount after closing would be returned to the borrower or to heirs. Retiring without a mortgage is a nice idea and some may not be able to buy a house completely free and clear. The reverse mortgage allows the borrower to have no payment and that can be rather reassuring especially in the hyper-inflation scenario we see brewing right now.

Tuesday, August 24, 2021

Vancouver One Step Closer to the Premier Retirement Living Experience

A few months ago I mentioned the Springs Living Development going in on Block 18 of the Waterfront. This project took a giant leap forward last week with the CCRA review of the project. This will be one of the most spectacular retirement communities in the entire metro area. A 12 story luxury tower perched right on the shores of the mighty Columbia River offering wonderful views of the water and the High Cascade volcanoes.

Washington's no income tax status helps retirees and this project should be able to attract people from all over the west coast. 250 units are expected and just about every amenity one could ask for. Of course a very short walk to the center of the Waterfront is a nice bonus.

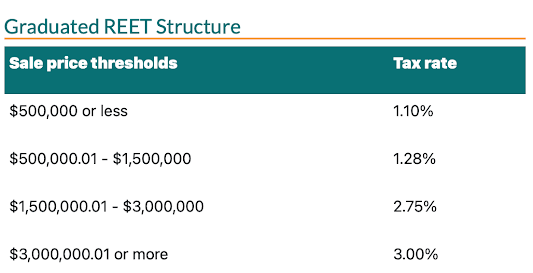

Last year Washington State reduced the amount of excise tax paid on homes valued at less than $500,000 but took it out on those with larger more expensive homes above $1,000,000. This is designed to help people and in particular fixed income seniors at the entry level housing but could put a wrinkle in the plans of those sitting on larger properties. Check out the Washington State graduated excise tax below. There is a minor variable from county to county as the local excise tax is NOT included on the chart below. The local excise tax is 0.50% and the local amount in other counties varies between 0.25% and 0.75%

Tuesday, July 27, 2021

California Retirees will Face Increased Expenses

California is putting the squeeze on retirees with ever increasing taxation that brutally attacks the middle class and the wealthy. Adding additional salt to an oozing and festering wound is the elimination of natural gas forcing new homes to be heated with electricity. California has trouble keeping the lights on already and prices per KW/hour in the Golden State are among the highest in the US. 65% above the national average and more than double the rate in Washington State. The pressure away from fossil fuels such as natural gas can only tax the already reeling California grid further which will undoubtedly lead to even higher costs. Higher costs for basic needs like electricity disproportionately affect the poor which then pressures the state to enact even more strict taxation on the middle class.

Those looking to retire soon should consider retiring outside the former Golden State. It is really more like the Pewter state these days. Perhaps a retreat to the east in Nevada or Arizona, or to the North in Oregon or Washington.

Washington remains one of the absolute best northern latitude states to retire with zero income tax and super low utility rates. Vancouver's bi-state border economics with Oregon allow for a diverse savings on taxes and expenses. Retirees are wise to consider Washington and Vancouver/Clark County is hard to beat.

Tuesday, June 22, 2021

Inflationary Period is Bad News for Retirees

Inflation is the enemy of all retirees. Generally retirees are on a fixed income that may have a COLA factor but in high inflationary periods the COLA rarely keeps up with real world prices. The numbers for inflation in April and May were atrocious hitting levels not seen it more than a decade. The real concern isn't a few months of inflation at high levels but rather a potential long term trend. I am seeing too many analysts suggest that our current pattern looks a lot like the patten in the 70s and that was not good, not good at all. There are some key differences in the 1970s and today however. Monetary policy has changed enough that the fed does have some stronger capability to stave off hyper-inflation. But the key approach still lies with manipulating the availability of money and that is done primarily with interest rates.

We have been in a ultra-low interest environment for a fair bit of time, and I believe it may be time to let rates creep a bit before things get into another bubble. Prior to 2015, the average mortgage rate over a fifty year period was about 6%. We have been well under that for a very long while and having rates on home mortgages creep a bit into the upper 4s and very low 5s would be healthy at this point.

Government spending in the crazy excess we see now is a propellent for inflation and I see no signs of a federal government crackdown on fiscal policy. Retirees are wise to be certain they do not commit too much of their income into living arrangements. Now more than ever, following the old school guidelines about income and "rent" or mortgage is a good idea. Build in a cushion so that if inflation does get out of hand you will be able to maintain your mortgage or rent and still provide basic living expenses.

Anyone over 50 should be seriously looking at long term savings and safer investments that preserve principal rather than aggressive investments that have a higher probability of volatile swings. Let's hope the government gets a handle on the fiscal spending and staves off hyper-inflation. I remember the late 70s and early 80s and it was not pleasant when trying to borrow money for a car or a house.

Retirees are well advised to not overbuy in retirement and in practice it may be wise to underbuy a little instead.

Tuesday, May 25, 2021

Vancouver USA About to get PREMUIM Retirement Choice

I wrote about the Springs Living plans for the Vancouver Waterfront numerous times over the last few years but it is now coming to fruition. The latest drawings are in and multiple reports suggest a January 2022 start with completion in 2024. The 12 story luxury project will be aimed at seniors over the age of 62 offering all three life phases from independent living, assisted living, and full care. The Springs Living is a fabulous company providing excellent care in a dozen or more locations from Oregon to Montana.

This will be their first urban high rise project and it looks really good. Not only is the building impressive, but the location is as good as it gets in the Northwest. This tower will sit right on the bank of the Mighty Columbia River offering stellar views of the Cascades, Coastal range, and city lights and skyline. Meanwhile down on the ground the spectacular Waterfront Park is right out the door and the amazing amenities of the Waterfront with the best restaurants, bars, and wineries just a short stroll away.Vancouver USA with its low taxes and excellent small urban vibe is a premier spot to retire. For more information visit the Springs Living website or www.urbanlivinginthecouv.com

Tuesday, April 27, 2021

It's another re-run ;) Retire to the Coast

Yes sometimes I pull a rabbit out of a hat and sometimes I pull a re-run out. SW Washington's coast is still a great opportunity for retirees. There are not many coastal beach towns that are reasonably priced, but the Long Beach Peninsula area is. So with out further ado, here is an article from a few years back, that still rings true today.

Originally posted 2/6/2018 on Evergreen Coastal Living, by Rod Sager

Many people that move to the Southwest Washington Coast are retired. It makes sense, really as retired people do not rely as much on the availability of high paying jobs as do those still in the working years. The coast is not exactly a hotbed of high tech nor is it filled with factory jobs. The only real stumbling block is that the coast is a fair distance away from the larger cities along the Oregon-Washington Interstate 5 corridor. The Long Beach Peninsula enjoys very reasonable housing costs and that can be a big bonus for fixed income retirees.

However there does come a time when we get older and need to visit our doctors a little more often. It is here that living on the quasi-remote coast can be an issue. There are plenty of physicians operating a practice on the Long Beach Peninsula and on the northern Oregon Coast, but hospitals and specialists may require an inland run to Longview which is 60 miles away.

This is probably the primary concern for retiring to the coast. If the medical services are adequate for your needs the rest is easy. Who doesn't want to enjoy the spectacular Pacific Ocean coastline? The weather at the coast is also more mild with wintertime temps a solid 8-10° warmer overnight and summertime highs an easy 10-15° cooler than most of the Portland Metro Area. Although the temps tend to be better moderated the rainfall is not. The coast can take a lickin' from frequent winter storms and that can mean a lot of rain and wind. Long Beach receives on average 79 inches a rain a year and that is double what Portland and Vancouver get on average. It's not that it rains more often, but more that it just rains harder.

But the coast is not that much different in terms of weather patterns and a nice long period of relatively dry conditions which arrive in July and stick around through the middle of September most years.

Yes friends, retiring to the beach isn't for everyone, but it could be just the ticket for you so check it out!

Tuesday, March 23, 2021

Gen X may hurt Retirement Communities

Tuesday, February 23, 2021

Washington State Income Tax Proposal Needs to DIE

Those pesky legislators are back at it again with the latest round of "we need an income tax" making its way through the committees on the floor of the capitol. First before any of you scream about the reduced tax revenue due to COVID... STOP right there! Washington was one of only a handful of states that saw an INCREASE in revenues during the pandemic and only Idaho had a larger increase. The legislature has a FULLY funded budget ready to go. Yet some greedy state policymakers want to crush the very spirit of taxpayers with a capital gains tax. The bill is

With the feds led by a full trifecta of big tax and spend politicians, Washington should be happy with their big fat surplus of revenue, and let the state's business recover from the COVID nightmare. Locals should be flooding the email boxes and mailboxes of every legislator from Democrat to republican and make it clear they vote for this, they find a new job!

This isn't the first time bloodsuckers in Olympia have tried some form of income tax scheme. Usually it is when the state is facing revenue losses or budget shortfalls. This is egregious what they are suggesting and they will no doubt try to make the case they are "sticking it to the rich." They are not, they are sticking it to all of us.

Just say no to government greed. The bill is Senate Bill 5096... BOOOOO.... HISSSS!

Wednesday, January 27, 2021

Retire to a High Rise?

originally posted March 26th, 2019

Many retirees are looking for living arrangements that don't require a bunch of yard work or travel to get to activities. Downtown urban condo living could fit the bill quite nicely for some. In SW Washington, Vancouver has a nice opportunity to own a high-rise condo unit with views of the Columbia River, Esther Short Park, and as many as five Majestic Cascade Volcanoes.

A short ride down the elevator to the street offers up everything your need in a few blocks. restaurants, post office, stores of all kinds, the park, waterfront, government agencies, banks, insurance, you name it and you can walk there.

This style is not for everyone, but it could be for quite a few retirees. 2 bedroom units range from $300,000 to well over a million dollars depending on the view and of course the interior decor and quality. Vancouver's downtown and waterfront area is rapidly becoming the hot spot for urban living in the Portland-Vancouver metro area.

This style is not for everyone, but it could be for quite a few retirees. 2 bedroom units range from $300,000 to well over a million dollars depending on the view and of course the interior decor and quality. Vancouver's downtown and waterfront area is rapidly becoming the hot spot for urban living in the Portland-Vancouver metro area.You can visit Urban Living in the 'Couv' for updates on condos for sale and project status for new and upcoming high-rise projects.